Shopping spree: Investors intensify search for retail property

Investor appetite for Aussie shops and retail real estate continues to strengthen, boosted by robust consumer spending, strong population growth and an undersupply of retail space.

New data showed buyer enquiries for shops and retail properties listed on Realcommercial.com.au rose 9% during the third quarter, or the three months to September, compared to the previous quarter.

Buyer enquiries for retail real estate also jumped 14% for Q3, compared to the same period last year.

It was a similar story for retail property listing views in the third quarter, growing 6% quarter-on-quarter and 13% year-on-year.

Increased enquiries and property views don’t automatically translate into deals, but they can signal improving sentiment.

Dexus bought a 25% stake in Westfield Chermside shopping centre from Scentre Group for $683 million in July. Picture: Supplied

RWC Retail joint managing director Michael Feltoe said competition for Australian retail property was heating up.

“It’s the busiest we’ve seen in years and we are receiving on average 300-plus enquiries for every retail property campaign, regardless of being regional or metropolitan location,” Mr Feltoe said.

“Buyers are circling hard, and any Australian retail property with good fundamentals is attracting unprecedented competition.”

Mr Feltoe said a recent gym-anchored retail property listing in the Brisbane suburb of Wynnum generated more than 370 enquiries, while a neighbourhood shopping centre in Townsville attracted 438 enquiries.

Investors spent $2.25 billion on Australian retail property during the third quarter, bringing retail sales nationwide to $7.61 billion for the year to date (YTD), up 45% compared to the same period last year, according to Colliers.

Yields have remained stable YTD, but Colliers noted that yield compression for retail real estate was likely to materialise during the fourth quarter if buyer competition continued to intensify.

It comes as resilient household spending, interest rate cuts, population growth and a shortage of retail space support the investment case for retail real estate.

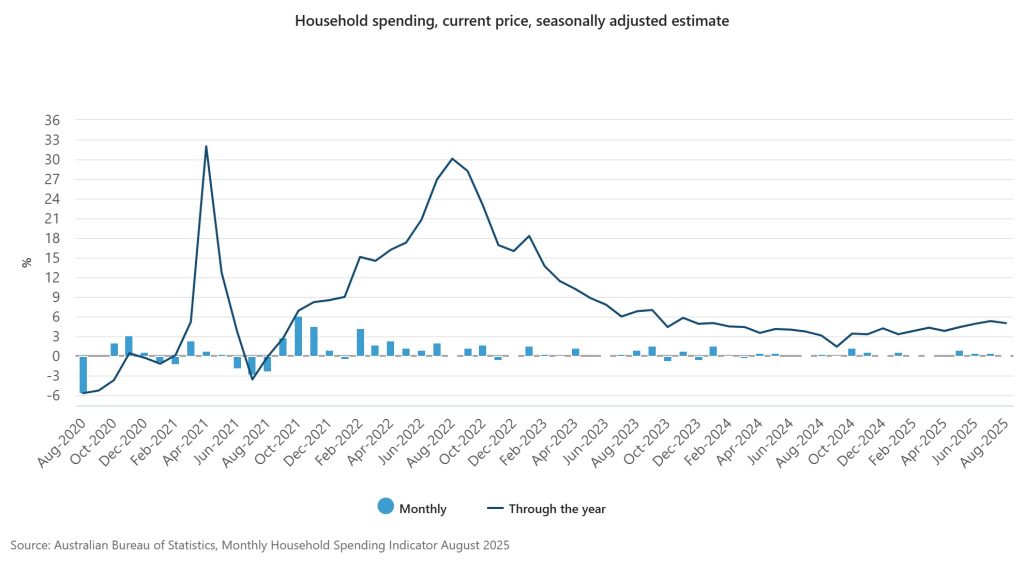

Household spending has remained elevated in recent months, up 5% during the year to August, according to the Australian Bureau of Statistics.

Australia’s population rose 1.6% year-on-year to 27.5 million people in March, boosting demand for goods and services from retailers, as well as for housing, infrastructure and more.

There has also been scarce retail property development across the country, limiting new retail space from coming to market despite the rising investor demand.

JY Group acquired a 50% interest in Sydney’s Bankstown Central for $318.6 million last month. Picture: Supplied

REA Group senior economist Anne Flaherty said these factors were helping attract investors big and small to retail property.

“We’ve seen an increase in investment to offshore investors, and we’ve also seen more larger investors such as real estate investment trusts (REITs) and institutional investors playing in the retail space,” she said.

“A lot of this has been driven by sales of shopping centres, so assets that are anchored by supermarkets, for example, are being competitively contested when they come up.”

Some of the biggest retail property deals in the third quarter include the $683 million sale of a 25% stake of Westfield Chermside shopping centre in Brisbane, and the $318.6 million sale of a 50% interest in Sydney’s Bankstown Central.