Industrial real estate: what’s driving the market in 2014?

Investor activity in the industrial real estate market continues to increase in 2014.

Solid returns on assets and the low cost of funds are attracting investors of all types to the market.

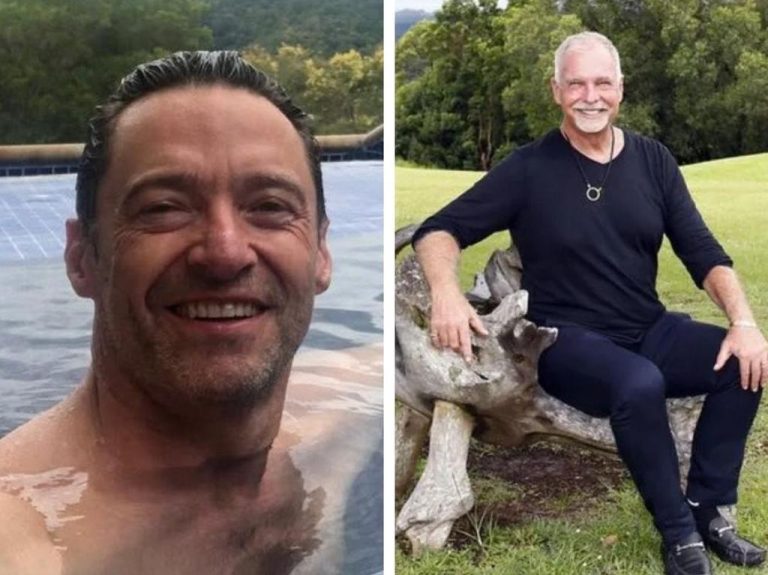

We spoke to Malcom Tyson, Managing Director of Industrial at Colliers International, about recent trends in the industrial real estate market.

Tyson says that in the past year, four investor groups have become much more active in the industrial market. These groups are private buyers, owner occupiers, local institutional buyers and offshore investors.

“Privates weren’t at all active this time last year, but have really increased their activity in the last 12 months” Tyson says.

He believes the “low cost of funds and the solid returns of around 7%-9% that industrial assets are offering are the drivers for these investors. They are having a significant impact on the sub-$15 million price bracket”.

The low cost of capital has also kept owner-occupiers active in the industrial market.

Tyson notes “there has been a lack of stock coming on to the market, and many of these buyers find it more financially viable and timely to purchase existing assets rather than build or buy new assets”.

Local institutional buyers have also increased their activity in the past year, again “driven by the returns offered by the industrial sector” according to Tyson.

The attractive returns offered by the industrial market have also sparked increased interest from offshore investors, who are either investing directly or via local operators – with Aviva’s recent investments in the Mirvac Group just one example of this.

Tyson says assets of $15 million and above that represent the latest generation product are receiving the highest levels of demand.

“Currently 75% of all investment enquiry is for this type of asset. This includes sites that have been developed in the last 10 years for the logistics space and offer all the modern necessities,” he says.