Hugh Jackman’s retreat partner caught in wellness fallout

Gwinganna’s sister property called EcoView Retreat is up for sale owned by Tony de Leede. Picture Glenn Hampson

Shock waves are hitting Australia’s booming wellness industry after a business linked to the partner of Hollywood star Hugh Jackman collapsed, throwing fresh scrutiny on a sprawling property empire built off the back of the fitness craze.

Tony de Leede – the entrepreneur behind Gwinganna Lifestyle Retreat and the man who brought Fitness First to Australia – has suffered a setback after his firm Wellness Solutions Group entered voluntary liquidation.

MORE: ‘Political suicide’: Investor’s brutal call on tax reform

Axed: Albo orders $3bn ADF sell off of 64 sites

Hugh Jackman at Gwinganna – his business partner is facing a major setback in his wellness pursuits.

Ecoview Retreat has 24 bedrooms.

Mr De Leede remains a shareholder in Gwinganna alongside Jackman, with the collapse highlighting the risks facing niche wellness coworking ventures as demand softens and operating costs rise.

His wellness firm, which offered corporate clients access to meditation pods, infra-red saunas, coworking hubs and flexible wellness spaces, counted major organisations among its customers including ANZ, Club Lime, YMCA, Goodlife Health Clubs and Stockland.

Mr De Leede said the closure was an “orderly wind-down”, adding staff had been supported and obligations met, but no details have been released about debts incurred with the closures of Mr De Leede’s Club W in Cronulla, Wello Works in Rosebery and his Move123 exercise video brand.

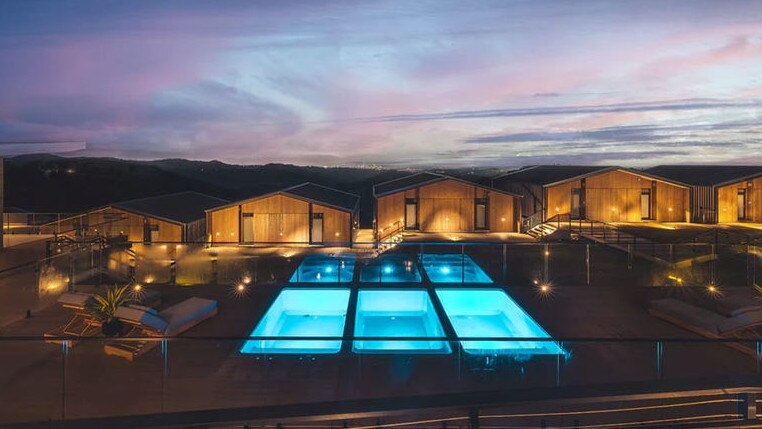

The collapse has turned attention to his broader portfolio of wellness ventures and property plays, including the listing of his 28-hectare EcoView Retreat near Gwinganna – a purpose-built estate featuring villas, event spaces and a private residence designed to capitalise on the retreat boom.

MORE: Dodgy tradie act sparks urgent Aussie warning

$850k windfall for Haas ahead of big move

His property at 660 Trees Road, Tallebudgera Valley, is for sale.

Ecoview Retreat has the main complex plus a stunning “caretaker’s residence”.

The property, marketed as purpose-built for retreats, corporate events and private functions, features 15 self-contained villas, five multipurpose spaces, and a separate four-bedroom residence with a granny flat.

The property at 660 Trees Road, Tallebudgera Valley, has 24 bedrooms, 20 bathrooms and parking for 22 vehicles.

No price has been made public for the property which is for sale via private treaty, located just 15 minutes to Burleigh Heads, 20 minutes to Gold Coast Airport and 60 minutes to Brisbane Airport.

Over the past decade Mr De Leede has bought and sold a string of Queensland properties, from Gold Coast beachfront homes to Broadbeach apartments and holiday investments, navigating wins, losses and rapid resales as the market surged through the pandemic.

Among the most notable was a house on coveted Hedges Avenue on the Gold Coast, purchased for $7.3m in 2009 and sold a decade later for $6.325m – a roughly $1m loss just before the pandemic – despite the area subsequently recording some of the strongest property growth in the region.

MORE: Albo under pressure as housing debate reignites

Buyer’s $1m lesson after shock off-the-plan apartment termination

His Ecoview Retreat has a short-term rental type concept for corporates looking to host their own retreats, but can also be a full-time business venture for the right operator.

A three-bedroom apartment in Burleigh Heads was transferred to his wife Snjezana De Leede in October 2024 for $1m after he had paid about $905,000 just over two years earlier.

A one-bedroom unit in the Phoenician at Broadbeach, bought in 2020 for $317,000, sold in 2023 for $515,000 – it was resold by the purchaser a year later for $590,000.

Another one-bedroom in the same building, purchased for $280,000 in 2020, sold around three years later for $485,000, and later resold by the new owner for $575,000 nine months afterwards.

A two-bedroom apartment in The Oracle at Broadbeach, bought in 2021 for $400,000 was sold in 2023 for $710,000. It later resold for $800,000.

A three-bedroom townhouse in Port Douglas, purchased in 2005 for $390,000, sold in 2021 for $1.33m after about 16 years of ownership.

These moves underscore how Mr De Leede has actively managed a significant property portfolio alongside his wellness ventures, balancing short-term flips, long-term holds, and high-profile developments.

The setback underscores the risks facing even high-profile operators as the post-Covid wellness surge cools, raising questions about whether the sector’s rapid expansion has run ahead of sustainable demand.