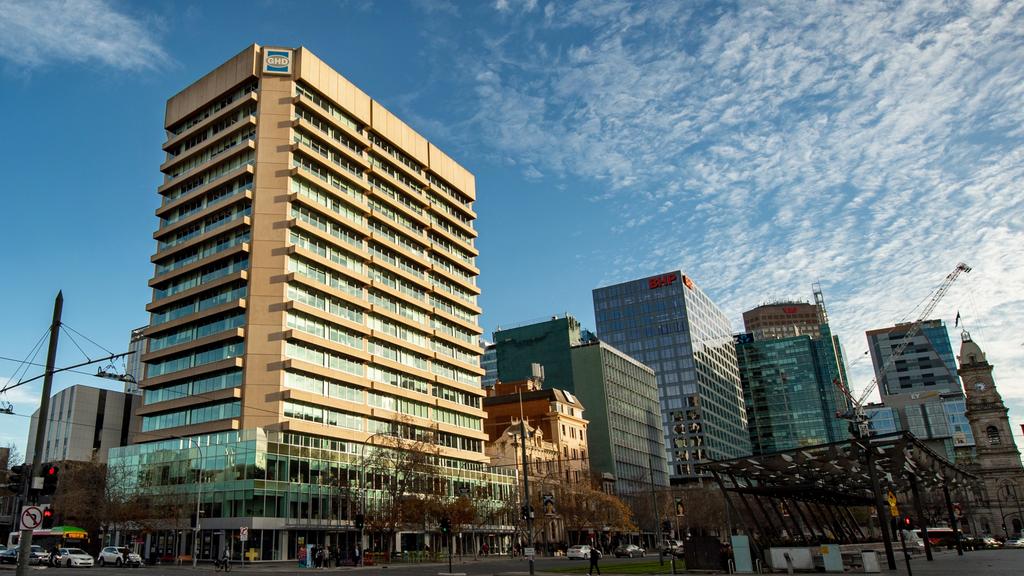

Harmony Property closes in on $130.5m office deal in Adelaide

The GHD Building at Victoria Square, Adelaide.

Harmony Property Investments is closing in on a deal to acquire the GHD Building in its home city, in what would be the largest office transaction in Adelaide this year.

The group has reached an agreement to acquire the tower for $130.5m, and is tapping its investor pool to fund the purchase.

A capital raising document obtained by The Australian shows Harmony is looking to raise around $70m from investors, and is forecasting an annual distribution of 7 per cent.

Harmony’s parent company, MRS Property, currently manages the 17-level, 17,774sq m building, which is 99 per cent leased to tenants including engineering firm GHD, William Buck, Taylor Collison, Statewide Super and several state and federal departments.

Reflecting a fully leased yield of 7.57 per cent, the purchase price was negotiated at a hefty discount to the $170m the market was expecting when the property hit the market in July.

“The property has a WALE (by income) of 5.0 years from settlement,” Harmony’s capital raising document says.

“Furthermore, 93 per cent of the building has been occupied by tenants who have been in the building for at least 10 years.”

211 Victoria Square, Adelaide.

Adelaide’s office market has withstood the challenges of Covid-19 better than most other parts of the country, given the limited number and duration of lockdowns and restrictions throughout the pandemic period.

According to the latest Property Council figures, 76 per cent of white collar workers have returned to their CBD offices in Adelaide, the highest rate outside of Perth.

And investors are circling, attracted to the steady and stable returns typically offered in the city.

Boutique fund manager Capital Property Funds has made its first foray into the Adelaide market with the acquisition of a 11,211sq m building at 63 Pirie St.

Sydney-based CPF has struck a deal to acquire the building from the Raptis family for $58.6m.

It is home to tenants including Lockheed Martin, Macquarie Group, Cowell Clarke and Bentleys, while a third of the floor area is currently vacant.

CPF executive director Andrew Kerr said the stability of the Adelaide market was attractive to investors in the wake of Covid-19.

“What we like about Adelaide is that it’s a stable market with attractive yields,” he said.

“By way of example, we expect the equity yield after gearing on Pirie St to be circa 8 per cent per annum.

63 Pirie St, Adelaide.

“We also really like the fact that there is no stamp duty in South Australia, as this translates into better outcomes for our investors,” Mr Kerr said.

“Our house view is that the current economic environment has provided opportunities to acquire commercial office properties that should deliver above average returns in the medium to longer term.”

Mr Kerr said unlike the industrial market, office properties did not get “overcooked” during the pandemic, and prices remained “reasonable” for opportunistic buyers.

“During the pandemic, pricing of industrial assets became quite sharp, primarily driven by a pandemic induced online shopping splurge and a desire to park money in safe haven assets due to record low interest rates,” he said.

“Now that the pandemic appears to be easing, industrial assets may see cap rate expansion and reduced rental demand as online shopping abates.

“Improving occupancy rates as workers return to the office will help the underlying fundamentals of the office market.”

Meanwhile, Quintessential Equity has struck a $73m deal to acquire Telstra House on Pirie St in Adelaide ahead of the telco’s move to Charter Hall’s $450m office development on King William St.

The building’s current owner, ASX-listed Australian Unity Office Fund (AOF), has been looking to sell off assets this year after investors knocked back a proposed merger with the unlisted Australian Unity Diversified Property Fund.

Quintessential’s purchase is conditional on the boutique fund manager finalising a green financing deal to fund a redevelopment of the building. Settlement is expected before the end of the year.

Cushman & Wakefield are managing the sale of the GHD Building, and are working alongside Colliers on the 63 Pirie St deal. Both agencies, and Harmony, declined to comment.