Global investment groups pump billions into healthcare property

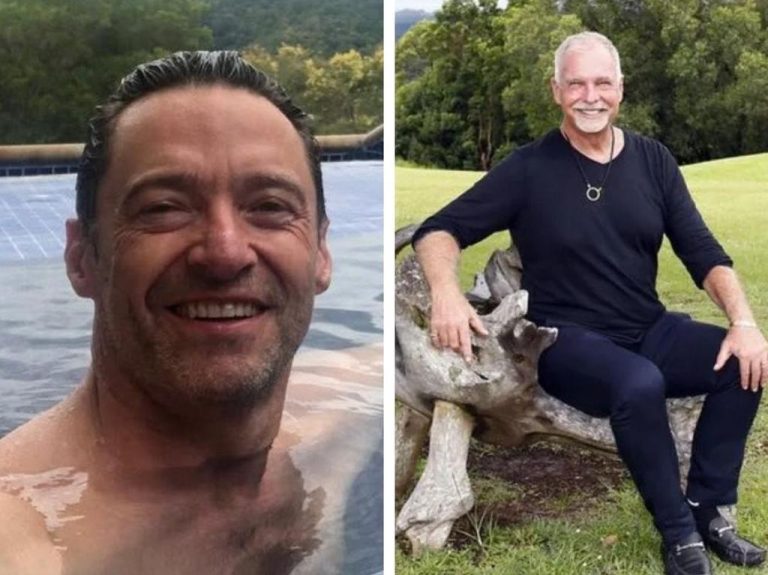

Centuria Joint CEO Jason Huljich sees more opportunities to expand in healthcare real estate.ay. Hollie Adams/The Australian

Global investors are chasing healthcare property with two of the biggest players unveiling deals that will see them develop and invest in billions worth of new hospitals and medical clinics.

In the largest play Canadian group NorthWest Healthcare Properties has announced a dramatic boost to its venture with Singaporean sovereign fund GIC.

The listed Centuria Capital has separately set up a new institutional healthcare partnership via a joint venture with a vehicle sponsored by Morgan Stanley Real Estate Investing, to be called the Centuria Prime Partnership.

In the Canadian deal, NorthWest Healthcare said its Australian business would expand its healthcare real estate joint venture with GIC in Australia by an additional $2.4bn, so total commitments would hit $6bn.

NorthWest Australia is already the largest owner, manager and developer of healthcare real estate in Australasia and first established its venture with GIC in 2018.

This venture had more than $3bn invested in its initial Australian institutional joint venture. The latest move will expand the venture by around 65 per cent, with the additional commitment of $2.4bn to be funded via debt and equity.

While it is separate, the commitment could help NorthWest if it again embarks on a tussle for control of Australian Unity‘s $3bn healthcare property trust. Its moves there were defeated last year as Dexus emerged as a corporate white knight.

But NorthWest also has a $3bn-plus development book in addition to its existing hospitals, medical centres, aged care facilities and health precincts.

In the Centuria deal the new fund is seeded with three healthcare real estate assets worth $210m, in keeping with its focus on assembling high quality portfolios. Centuria has identified further assets for CPP.

Centuria joint chief executive Jason Huljich said the partnership with Morgan Stanley “provides another opportunity to use our strong in-house healthcare real estate capabilities and further broadens our access to additional capital sources”.

CPP’s seed assets include the $75m Adeney Private Hospital in Melbourne‘s Kew, which will be operated by a joint venture between doctors and private health insurer Medibank. There is also the Westside Private Hospital, Brisbane, and the $38m Mater Private Hospital in Townsville.

Centuria Healthcare managing director Andrew Hemming said the company had grown its healthcare asset to about $1.7bn by focusing on healthcare real estate models of care that are cost-effective and deliver better patient care.

“We will continue to focus on the acquisition of institutional-grade properties as well as developing out our $900m healthcare pipeline,” he said.