Fun and games as Timezone plots massive expansion

The Quadrant Private Equity-backed owners of the Timezone entertainment empire plan to double their outlets as shopping centre landlords cast for new ways to draw consumers in the tough retailing environment.

Scott Blume, managing director of The Entertainment and Education Group, which formed last year when Quadrant bought a half share in the Timezone business, says the e-games sector has moved from “small fun parlours stuck in dark alleys” to become a global retail business.

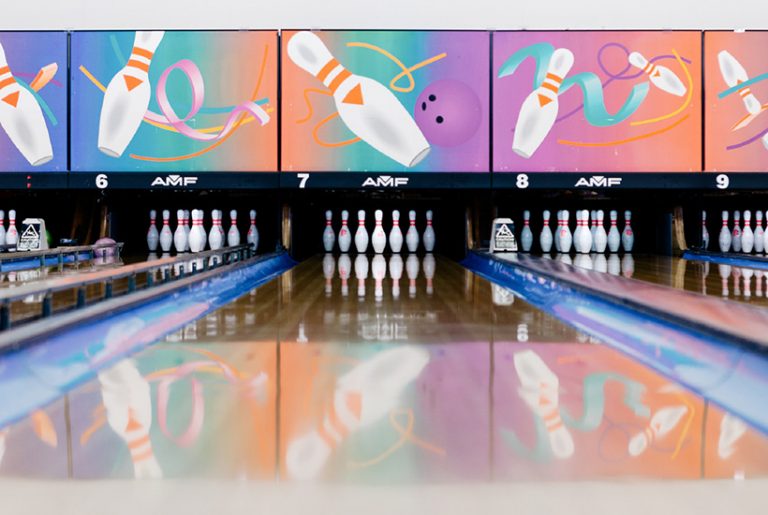

In May, the float candidate paid $160 million for the bowling businesses of Ardent Leisure as retailing is recast from solely selling things to selling experiences, services, food and beverages.

Commercial Insights: Subscribe to receive the latest news and updates

The Australian company, which is now based in Singapore, owns Timezone, Play ‘N’ Learn, Zone Bowling and Kingpin, which draws nine million visitors across seven markets.

Visitors spend $350 million a year — a figure that is set to rise to at least $750 million as TEEG moves to double its number of sites from 275, according to Blume.

I expect we will have at least 400 sites in the next couple of years

The group’s entertainment venues occupy 276,000sqm of some of the region’s busiest shopping centres. Eighty of those are in Australia, where they take up a total of 160,000sqm.

“We are talking to developers everywhere in the region, and in Australia,” Blume says.

“We have signed leases for centres for opening in 2019 and 2020. We know exactly what our future pipeline looks like.”

Of the offers for space, only half would be accepted as suitable for TEEG family games stores.

“At any one time, we are working on 40 new stores,” Blume says. “I expect we will have at least 400 sites in the next couple of years. There is massive pent-up demand from developers for what we can offer.”

Timezone is planning to double the number of outlets it operates.

In Australia, TEEG works with Scentre, Vicinity, AMP Capital, Lendlease, Mirvac and other shopping centre owners, including Blackstone.

TEEG also works with large Asian developers, such as Singapore’s Frasers Property, Indonesia’s Lippo Group and The Philippines’ Ayala Land.

Recently, TEEG signed leases to take space in two Blackstone-owned centres in India. It has also opened a store in Lendlease-managed Parkway Parade in Singapore. Timezone occupies space in Frasers’ shopping malls in Singapore and Sydney.

The company’s growth spurt came after Timezone’s founder, Malcolm Steinberg, sold 50 per cent of the business to Quadrant for an undisclosed amount in November last year. They formed a joint venture, TEEG, to be the holding company for family entertainment businesses.

Steinberg, 80, started the Timezone business with a single store in Perth almost four decades ago, and then expanded to Asia in 1995.

We have signed leases for centres for opening in 2019 and 2020. We know exactly what our future pipeline looks like

“We have massive capital requirements if we’re going to take up the opportunities that are coming to us,” Blume says.

Apart from rents, the set-up cost of each venue can range up to $3m, with ongoing reinvestment also needed to maintain its leadership position in the market.

“Quadrant brings capital to the table to allow us to grow fast. The only thing slowing us down now is execution and people, not capital,” Blume says.

“There are just too many opportunities out there.”

The Quadrant capital infusion funded the purchase of Ardent Leisure in May.

Blume says two new lines, Zone Bowling (for families) and Kingpin (for millenials), will generate growth, especially in the company’s mature markets.

As an example, he says, Timezone is probably “maxed out” in Singapore, with room for just two or three more venues.

Future growth will come from Kingpin, which can be operated on much larger standalone sites outside shopping centres, and Play ‘N’ Learn for children under six.

TEEG has bought out its Indian partner, Shoppers Stop, as it primes itself to expand quickly to 40 sites to meet the massive demand in that country.

Australia remains TEEG’s core market, but large populations in Indonesia, the Philippines and India are engines of future growth. The company has just moved into Vietnam, and plans to enter Thailand, and possibly another market, by 2020.

This article originally appeared on www.theaustralian.com.au/property.