Canadian equity giant Brookfield moves on Rydges Sydney Harbour

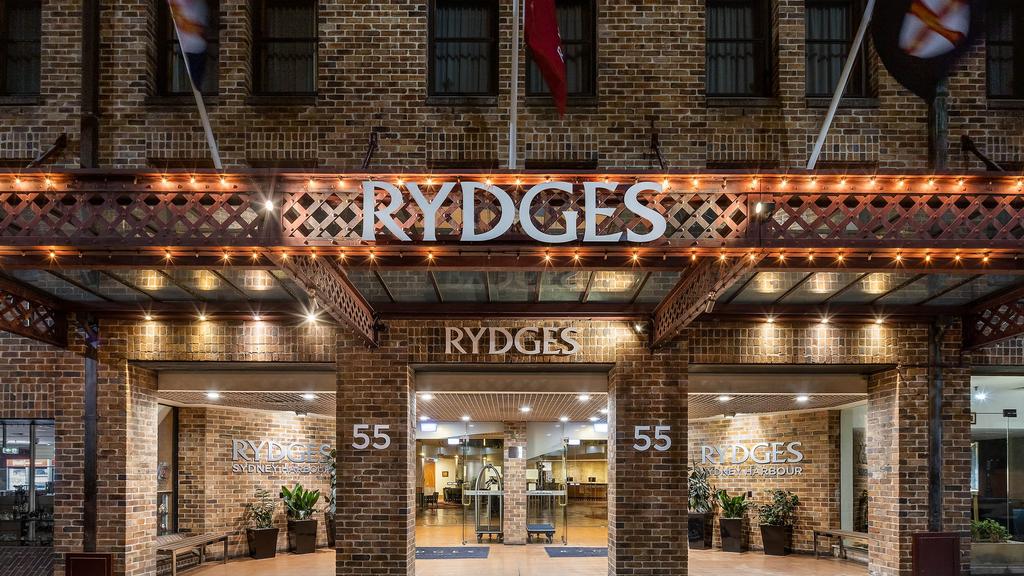

The Rydges Sydney Harbour is being pursued by Brookfield. Picture: Supplied

After a decade in abeyance, Canadian asset management giant Brookfield is said to be making its first move back into the Australian hotel investment market, negotiating to purchase the Rydges Sydney Harbour hotel in the historic Rocks precinct for $103m.

The 176-room hotel is being offloaded by Sydney businessman Chandru Tolani of New Landmark Hotels after he listed it through Colliers late last year with hopes of around $130m, similar to the purchase price of the former Primus Hotel in Pitt Street by Pro-Invest at the opposite end of the city.

When Brookfield purchased Thakral a decade ago for $400m it sold the entire hotel portfolio, including the Sofitel Brisbane Central and the Novotel Brighton Le Sands in Sydney.

While the move is an early stage, buying the hotel at 55 George St would give Brookfield an asset near Circular Quay, the Opera House, the Walsh Bay Arts Precinct, Sydney’s CBD business district and tourism hubs like the Overseas Passenger Terminal.

The Rydges Sydney Harbour is being pursued by Brookfield. Picture: Supplied

The hotel appeals to both the domestic leisure and corporate markets, and will access the rebounding international tourism market, as global vaccinations rise and international travellers seek out safe destinations that have managed the pandemic well, according to marketing agent, Colliers head of hotels, Gus Moors.

“The hotel has a history of strong performance owing to its unique location with stunning harbour and city vistas from all accommodation rooms. This asset offers investors the potential for tremendous upside through select capital works to reposition for the decade to come, against a backdrop of recovering global tourism,” said Colliers.

The Rydges Sydney Harbour is being pursued by Brookfield. Picture: Supplied

The hotel is located on a 1825sq m island site, occupying two buildings over six and eight floors, with a 55m George Street frontage.

The hotel features a rooftop pool and event area with panoramic views of Sydney Harbour Bridge and the Sydney Opera House, while its guest rooms range from 24sq m to 77sq m.

Last sold in 2003, the hotel has a long-term ground lease with 80 years remaining. Vacant possession is available from January 1, 2025.

Mr Moors said the hotel was in due diligence, but declined to comment further to The Australian.

If the deal is finalised it will lock in NSW’s status as the most active state for hotel deals. Last year there were 29 sales worth about $1.3bn as purchasers looked to capitalise on rare opportunities in tightly held markets and looked past the pandemic.

Volumes were boosted by some big-ticket sales in Sydney, with more than $1bn of hotels still in play, including Bright Ruby’s divestment of Hilton Sydney. Notable deals included Sofitel Sydney Wentworth ($315m), the InterContinental Double Bay ($175m), Four Points by Sheraton ($150m), Primus Sydney ($132m) and Vibe Rushcutters ($123m).

The Rydges Sydney Harbour is being pursued by Brookfield. Picture: Supplied