Bunnings reveals plans to dominate UK market

Bunnings has plans to expand across Britain and could buy or lease more than 100 sites in coming years as the Australian group becomes a major presence after buying Homebase last year.

Bunnings owner Wesfarmers bought the chain for $704 million and is converting its 256 stores into its own brand. It has confirmed plans to open 20 stores in Britain by the end of this year.

This would be the start of its push into the British market and it had plans for 102 openings over the next five to eight years, trade journal Property Week reports.

Commercial Insights: Subscribe to receive the latest news and updates

Wesfarmers has pledged to invest more than $1 billion on the Homebase business, which includes the rollout of new Bunnings pilot stores in Britain and a new online store.

To hit these aggressive targets the company will experiment with smaller high street stores of just under 2000sqm to almost 5000sqm, far less than most of its local outlets.

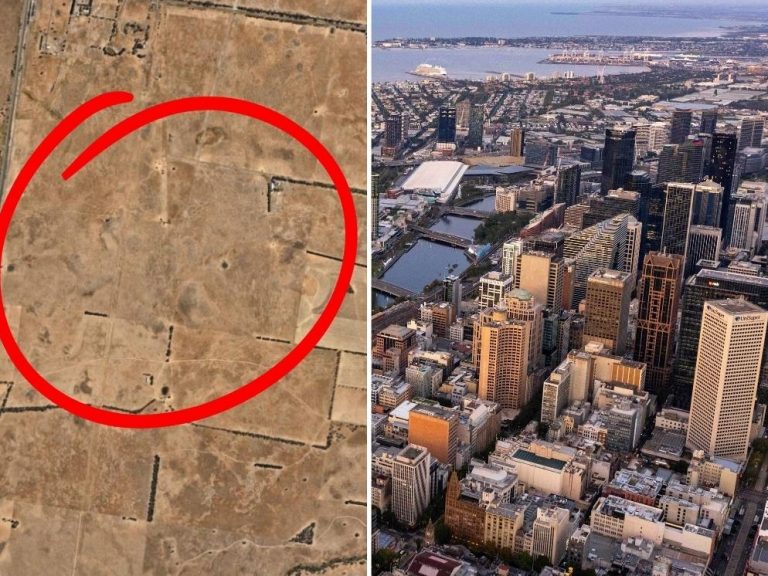

Inside the Bunnings at Folkestone.

Bunnings says it is adapting its traditional large format model to British conditions and will open the smaller stores this year to test their performance.

As it does in Australia with the support of parent company Wesfarmers, Bunnings says it will look to acquire freehold assets that it can occupy, as well as leasing property.

The group’s managing director, UK & Ireland, Peter Davis, says the company will buy property and turn it over as it goes through the investment cycle, and its investment will be “quite big”.

It is also chasing sites of up to 20,000sqm for its more standard warehouses. It has leased three properties and bought one.

Bunnings has also opened a new store at Broadstairs.

In a sign that it will target built-up areas as well, Bunnings says it is weighing up developing multi-level stores where it will operate on the ground floor and units could be built above its stores.

While uncommon in Australia, increasingly supermarket players Coles and Woolworths are working with residential developers in Sydney and Melbourne as sites have tightened up in inner-city areas.

Wesfarmers’ UK and Ireland business in August turned in a $89 million loss in its first full financial year since the acquisition of British chain Homebase.

While profit at Bunnings local operations lifted by 10% to $1.33 billion, the British result prompted questions from analysts about Homebase’s pricing model.

This article originally appeared on www.theaustralian.com.au/property.