Blackstone to launch world‘s largest industrial property sale of 2021

US private equity giant Blackstone has hired advisers for what is being pitched as the world‘s largest industrial property sale of 2021 with the company to offer a $3.5bn Australian logistics property portfolio.

Blackstone will run a dual track process kicking off in mid-January that could also see it float the assets as a real estate investment trust on the Australian Securities Exchange.

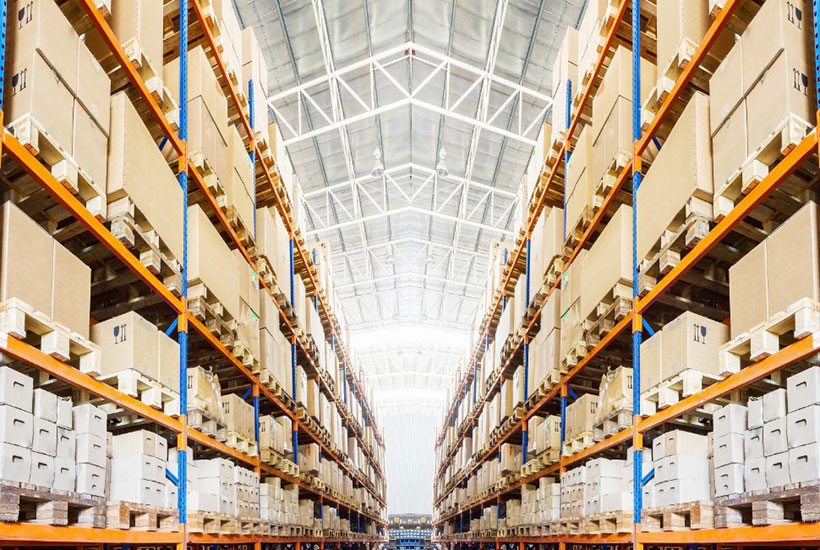

But with industrial warehouses in such hot demand on the back of the e-commerce boom the portfolio is likely to be snapped up by a major player.

Blackstone has rapidly amassed a $12bn property operation in Australia with a focus on game changing plays and it has aggressively purchased industrial property assets from players including the listed Goodman Group to build up one of the largest industrial portfolios in the country. It has about 90 assets worth about $4bn.

Blackstone has tapped investment banks JPMorgan and Morgan Stanley, as well as real estate advisers including US firm Eastdil Secured and global firm JLL, sources with knowledge of the deal said.

Industrial property has proven to be one of the private equity group‘s more savvy bets since it set up in Australia, with it starting to buy many years ahead of its rivals and before the structural shift towards logistics assets.

Logistics property has emerged as the hottest area of global institutional real estate and Blackstone has made major strides in expanding the sector. Last year it acquired more than $25bn worth of industrial properties in the US alone, which include warehouses and logistics facilities in the US streaking ahead of competitors. Blackstone last year forked out $US18.7bn to buy a portfolio of urban logistics properties – used by the likes of Amazon to ship products to customers – from Singapore’s GLP, nearly doubling its US industrial holdings. The private equity firm also bought another portfolio from US group Colony Capital for $US5.7bn.

The company has long been a leader globally in assembling logistics and industrial property platforms and then selling them when they have reached maturity.

In 2014, Blackstone sold a US industrial platform, IndCor Properties, to Singapore’s sovereign wealth fund GIC for $US8.1bn.

Last year Blackstone sold a major national logistics portfolio with more than 100 properties across 12 US markets to funds manager Nuveen Real Estate for $US3bn.

Logistics property has gone from a workmanlike field to a booming sector whose transformation has been aided by the coronavirus crisis with the pandemic driving a dramatic increase in industrial property values.

Investors are also chasing the long leases being taken up by major corporations as companies commit to increasingly complex warehouses where they are investing hundreds of millions of dollars.

Major corporations around the world are also looking to slash costs by restructuring their supply chains, seeing this as a means of boosting earnings during tough economic times.

A sale would also bring into sharp relief the rise of the logistics sector while the once dominant mall sector lingers in the doldrums.

Potential bidders on the industrial portfolio would likely include local managers led by Charter Hall, Dexus, and Centuria Capital as well as diversified companies that have strategies to expand in the sector including the GPT Group, Stockland and Mirvac.

All these groups and local funds houses including Lendlease and AMP Capital would need to tap wholesale funds to be competitive as the process would also attract global funds houses.

The sharpest bids could come from Singaporean companies that established beachheads in the local sector about five years ago and have since built out industrial property platforms with the likes of Ascendas, Keppel and Mapletree potentially bidding. Blackstone has the capacity to float property companies and has a well regarded local management operation in 151 Property but lacks experience in the local listed sector and could achieve a potentially cleaner exit with an outright sale.

But the firm has grown its own capacity in the area and could also retain a separate portfolio both of passive assets and development sites. It is separately running a process for another industrial $800m property portfolio that it holds with Fife Capital.

Blackstone declined to comment.

This article originally appeared on www.theaustralian.com.au/property