Affordability heats up Hobart commercial property

Relative affordability, keen demand, limited buying opportunities and a strong economic performance have contributed to heightened investor focus on Tasmania’s commercial real estate market.

Office, industrial and hotel assets are highly sought-after investments for local, mainland and international buyers after several high-profile properties sold for well above initial price expectations in the past 12 months.

Knight Frank Hobart partner Scott Newton says the unprecedented number of significant development sites that have recently sold is a reflection of Tasmania’s economic growth, the stable government, and the low interest rate environment.

Commercial Insights: Subscribe to receive the latest news and updates

“There’s been a number of major shifts and players enter the market, one of which is the hotel sector where there’s clearly a number of new hotels being built on the back of increased tourism demand and the attractive nature of Hobart as a destination,” Scott says.

“Also the University of Tasmania’s decision to relocate campuses into the inner city has created a level of activity in itself.”

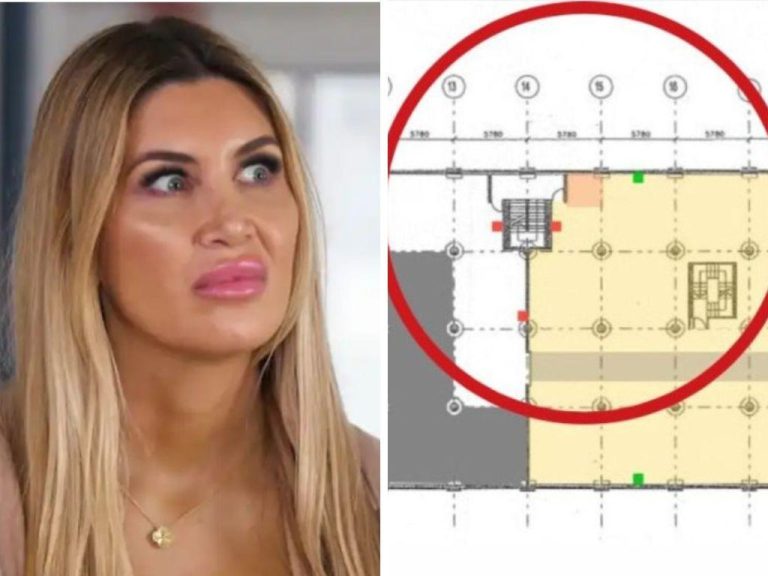

103 Melville Street, one of the large city sites purchased by UTAS.

He says historically Tasmania’s market was reasonably benign over a 10- to 15-year period, with values tending to “step up” rather than increasing gradually.

“We saw it last time in 2003 when there was a significant step up in values in a broad sense,” Scott says.

“Mainlanders all of a sudden see Tasmania as a desirable place to invest, and part of the reasoning is they see there’s better value here.

“When the mainland markets become overheated, it pushes capital into regional areas, and Hobart has been a beneficiary of that.”

66-80 Collins St.

Industry stakeholders will be keeping a careful eye on the expression-of-interest campaign launched this month for the Telstra Centre at 66-80 Collins Street, Hobart.

The campaign, managed by Knight Frank Hobart and Edwards Windsor on behalf of the vendor, Retirement Benefits Fund, closes on August 29 and is expected to attract offers of more than $30 million.

Hobart’s falling office vacancy rate and lack of new supply are fundamentals buyers will weigh up.

According to the Property Council of Australia’s Office Market Report 2019, Hobart’s CBD vacancy rate of 5.9% indicates the market has tightened considerably in the past few years.

Bunnings Warehouse site sold at auction for more than $14 million.

The vacancy rate is down 3% since 2015 and ranks Hobart as having the third tightest office market behind Melbourne and Sydney, where vacancy rates are 3.2% and 4.1% respectively.

The Telstra Centre sale is one of the year’s most high-profile commercial buildings to come to market, following the $50 million sale of the MACq01 waterfront hotel building in June to a consortium of local buyers that included the Farrell family.

The public sale campaign through JLL Hotels & Hospitality Group attracted significant offshore and domestic interest.

It is one of four hotels JLL Hotels has transacted in Tasmania this year.

“There is no doubt investors are increasingly recognising the outstanding fundamentals of the market and its growth potential,” JLL Hotels executive vice president Peter Harper said at the time of the sale.

Coogans sites in Hobart and Moonah sold recently in excess of $13 million.

Elsewhere in the city, the University of Tasmania outbid five other interested parties to secure the 1.3ha former K&D site on Melville Street, where it plans to use the entire city block for green space, teaching and learning facilities and student accommodation in an arrangement that will be funded through its partnership with investment consortium Spark.

Devine Property director Mark Devine says Hobart’s economic fundamentals as well as its stable environment and margins are proving more attractive than other major metropolitan markets.

He says while industrial, office and hotel assets are selling well, Hobart’s retail environment has softened in line with the rest of the country as the sector battles with falling consumer confidence and fierce competition from online trade.

“People are always looking to get bang for their buck,” Mark says. “There’s a lot of general confidence and appetite to get involved in Tassie at the moment.

“Hobart is now seen as a vibrant place — the tourism numbers support that — and as more people come and experience what we have to offer and tell others, some decide they may want a piece of the pie. That’s helped to create the market we’re experiencing now.”

This article from The Mercury originally appeared as “Affordable yet in demand, Hobart’s commercial market is hot”.