Shopping centres in vogue as fund managers chase bigger deals

The Gold Coast’s Harbour Town is a shopping centre concept that incorporates multiple factory outlets in one building.

Big shopping centre deals are firmly back on the agenda and the latest wave of deals signals that their values have avoided a deep plunge in the wake of the coronavirus crisis.

Billions of dollars of capital is now lining up for more transactions after a run of sales showing that malls have fallen from their lofty peaks but markets are again liquid.

Investors are also betting that Australia will repeat the overseas experience of consumers embarking on “revenge spending”, with local spending buoyed by rising house prices and high business confidence, which could lead into a delayed “Roaring 20s”.

But the recovery comes against the backdrop of some malls still struggling and CBDs making only a slow come back. The industry is also dotted with centres which are “caught in the middle” – unable to attract customers as they are neither destination malls or offering convenience shopping.

Now, both savvy fund managers are buying centres where they can lift performance, and big institutions are alive to repositioning and mixed use plays in the new retail world.

In a deal that signals listed buyers are truly back Vicinity Centres this week struck a deal to buy a 50 per cent stake in Gold Coast’s Harbour Town outlet shopping centre from the Lendlease-managed APPF Retail for $358m.

Vicinity chief executive Grant Kelley pointed to the growing markets for outlet centres and cited the attraction of the Gold Coast as a destination.

“Harbour Town is located in an attractive trade area and the centre’s annual moving annual turnover is more than double the average MAT for Vicinity’s current outlet portfolio.”

Macquarie analysts said Vicinity could continue buying as spending just over $500m would take it to the mid-range of its deployment capacity.

The was deal negotiated by CBRE’s Simon Rooney and joint agents Sam McVay and Dan McVay of McVay Real Estate.

Mr Rooney said the expressions of interest campaign was competitively contested, attracting domestic and offshore institutions, and syndicated investors.

“The Harbour Town transaction and strong market interest it has attracted, is only reinforcing the increasingly positive change in investor sentiment as it relates to retail as an asset class, translating into a marked resurgence in demand and investment activity,” he said.

“We are expecting at least $2.5bn in major retail assets to change hands prior to year-end, the comparative value proposition and returns becoming increasingly compelling, as high quality and rarely traded retail assets become available,” he added.

GPT is selling Casuarina Square in Darwin to Sentinel Property Group for about $420m.

Mr McVay said the huge increase in online retail was starting to flatten out as some e-commerce vendors were hit by heavy returns and retailers found they needed to also use their shops for last mile delivery.

He said US retailers were now expanding their spaces for both display shopping and also to ensure they could store goods, in a trend that could hit in Australia.

The sales rush really began with GPT’s shopping centre fund moving to sell Wollongong Central to Sydney-based property funds manager Haben for just over $400m, via Lachlan MacGillivray of Colliers.

While he will not comment on transaction specifics, the managing director of Haben Property Fund, Ben Finger, called for differentiation within the retail sector.

“The negative sentiment on retail tended to focus on ‘all retail is one retail’. Retail has been 90 per cent of our business since inception and our strategy, by design. Our focus is on acquiring centres in line with our long-term strategy – location, mixed-use and land rich assets,” he said

“While the pandemic impacted cash flows, our fund had a strong level of protection due to the non-discretionary nature of our portfolio and the continued demand for retail products and services,” Mr Finger said.

“We are optimistic about the retail sector and see its strength remaining post-Covid. We are essentially buying income and future capital growth, so the focus for us is the confidence in the fundamentals of the assets we acquire,” he said.

GPT and its fund are also selling Darwin’s Casuarina Square shopping centre to Sentinel Property Group for $420m in a deal being brokered by JLL. The firm wouldn’t comment on the deal but points to the new capital chasing the recovering retail investment market with private investors, syndicates and private developers making the running.

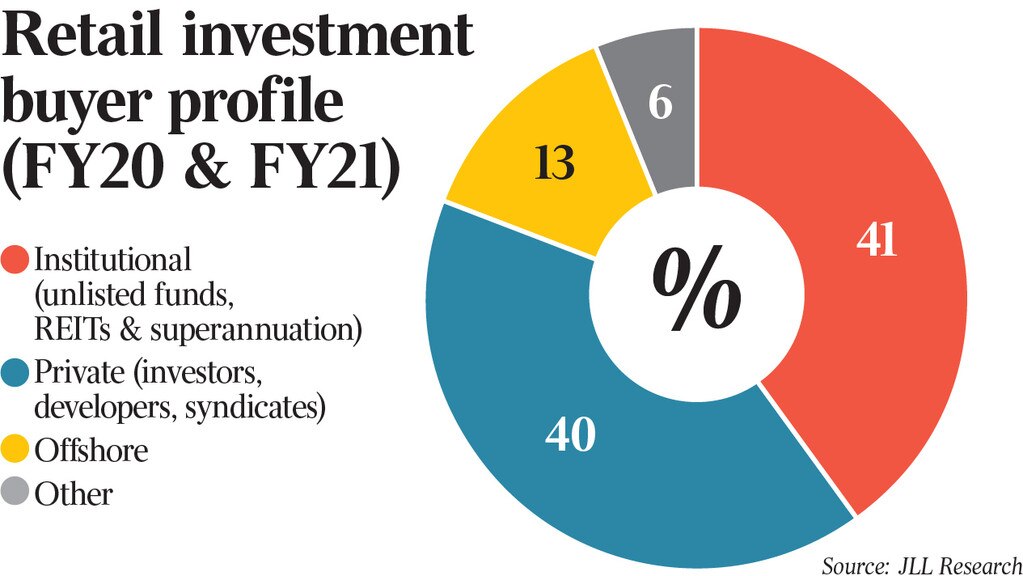

The private players have dominated the retail buyer profile, accounting for the biggest share of shopping centre buys over the past two financial years, with JLL Research saying their buying had leapt to $5.7bn.

They made up 41 per cent of buying, edging out institutions that were at 40 per cent share.

Newer players are driving acquisitions with one time single asset syndicators moving up into new price brackets, topping $150m, with key buyers IP Generation, Primewest and Newmark among the top 10 acquirers during the pandemic period.

Despite Covid, their buying meant the strongest first-half for shopping centre deals since 2013, with more than $4bn of buys in the first half of 2021 and another $1.7bn in the September quarter.

Investors are chasing retail assets that represent low risk with essential services tenants, convenience retail, and that have lifted their performance during the crisis, such as big-format retail, performing best.

JLL retail investments senior director Nick Willis said the firm’s campaigns over the past six months had resulted in more than $5bn of underbidder capital, which was “ continuing to pursue retail opportunities”.

About a fifth of this was new buyers seeking their first retail investment, and they were focused on convenience and big-format sectors, but also engaging on bigger subregional and regional assets.

IP Generation exemplified the jump up the value chain and it picked up Midlura Central from Vicinity. Managing director Chris Lock said the company was looking at both non-discretionary and discretionary as opportunities.

“We continue to have conviction in the sector and see more value in both larger retail assets and the smaller convenience centres,” Mr Lock said. “Given the increasing competition within the non-discretionary sector, we’re selectively looking at larger retail assets of $100m or above.”

Such groups are also buying portfolios – with IP Generation buying six neighbourhood shopping centres in NSW for $300m – or bigger assets such as Casey Central in Melbourne, which traded for $225m to Haben.

Mr Willis said neighbourhood and big-format subsectors remained highly contested, but the supply of investment product was constrained. “Syndicator and boutique managers are now looking to expand their portfolios through the acquisition of larger shopping centres given their relative value and increased availability through the rebalancing of broader national portfolios,” he said.

The next big retail contest comes as the country’s biggest landlords line-up for a slice of Sydney’s landmark Macquarie Centre and the Pacific Fair Shopping Centre on the Gold Coast.

Pandemic pricing, it would seem, no longer applies for the $700m offering.