Shoppers flock back to Westfield centres

Shoppers appear to be flocking back to stores, with the owner of Westfield malls in Australia saying customer visits are getting close to the levels of a year ago, but Melbourne’s coronavirus outbreak will force some retailers to wind back their operations.

Scentre Group, which operates the local Westfield mall empire, also reports a pick-up in customers dining out and using beauty services, in unaffected areas of Australia.

The listed mall company said about 92% of retail stores in Australian Westfield centres were open. In NZ, where coronavirus restrictions have eased further, 94 per cent are open.

But the emergence of virus hot spots in Melbourne has affected a series of major listed retail property landlords.

Scentre confirmed Westfield Airport West was in an area identified by Victorian Premier Daniel Andrews where lockdown rules will apply.

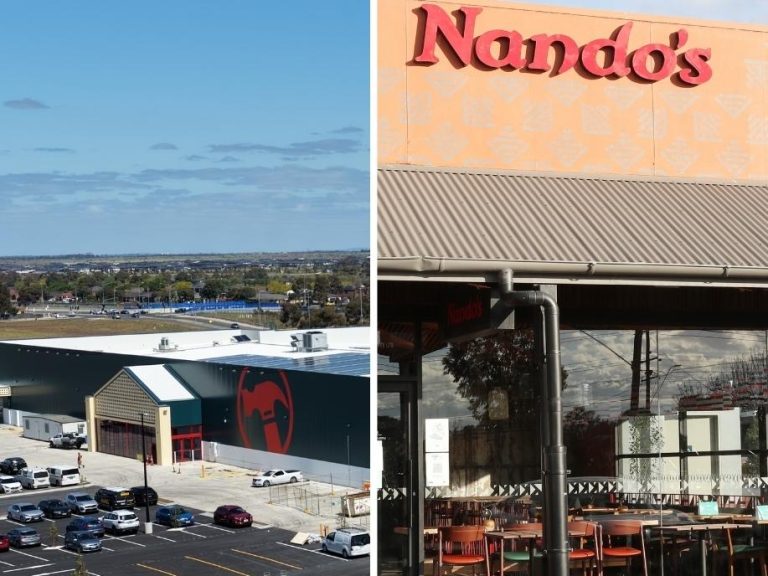

GPT Group’s massive Highpoint Shopping Centre Melbourne in Maribyrnong is also affected and like other centres will stay open for essentials, providing access to food, groceries, household items, products, medical services and banking.

But cinemas and indoor entertainment, gyms, pubs and licenced clubs have been instructed to temporarily close. Cafes and restaurants will be restricted to takeaway only.

The Vicinity Centres-owned Broadmeadows Central and Roxburgh Village shopping centres are also in hot spots as is Lendlease APPF Retail’s Craigieburn Central.

Vicinity said it was continuing to monitor government advice and announcements about recent cases, particularly those in Melbourne, and had physical distancing guidelines, regular cleaning and further precautionary measures such as heat-mapping to relieve potential congestion.

Despite the coronavirus outbreak in Melbourne, more stores are slated to open nationally in July when restrictions on some entertainment, experience and dining categories are lifted, such as cinemas, gyms and food courts.

Some category restrictions remain in Australia, but last weekend customer visits across the entire Westfield portfolio returned to 86 per cent of the same time last year.

In some centres, daytime visitation is back to 90 per cent of what it was in the same period last year. Night-time visits are expected to lift in July as entertainment and leisure options open up.

Scentre director, customer experience, Phil McAveety, said customers were telling Westfield that they want to get out and about again.

“Consumer spending by category post restrictions matches the pandemic experience and easing of restrictions — supermarkets and premium food continue to perform well; youth-oriented and contemporary fashion has bounced back, as have beauty services. The night-time economy is expected to lift throughout July in line with further easing of restrictions on entertainment, leisure and dining,” he said.

However, Jefferies head of Australia real estate Sholto Maconochie warned that retail sector concerns remained, including because of COVID-19 increases in Victoria.

Maconochie said Scentre’s gearing and balance sheet was still of concern given the effects of COVID-19 and the impact on tenants’ ability to pay rent.

“We will need to see stabilisation in equity markets post COVID-19 and more government intervention vis-a-vis rental assistance for tenants and the impacts for landlords,” he wrote as he upgraded Scentre to a hold rating.

“While we still expect balance sheet pressure to remain from falling rents and asset values, Scentre benefits from low weighting to Victoria and a smaller tail of weaker assets over Vicinity Centres, without the drag of a highly dilutive equity raise,” Mr Maconochie said.

On the ASX, the recent reopening trade has waned with Scentre down 21 per cent from its June 20 high of $2.73. It closed 2c higher at $2.17 and Vicinity was steady a $1.43.

This article originally appeared on www.theaustralian.com.au/property.