How to set up a shared office space in 4 easy steps

While co-working is definitely hot right now, setting up a shared office space isn’t as simple as it first appears.

Among the many challenges for wannabe co-working moguls are working out how much to charge per person or per desk.

Brendan Dixon – who runs his business, Pure Finance, out of a co-working office space in Sydney’s Surry Hills, which he also owns – says calculating the number relies on experience, market research and careful budgeting.

1. Be a tenant first

Dixon says it’s best to have some experience as a tenant before setting up a shared office space, to help understand what’s affordable from the tenants’ perspective and to also learn about the good, the bad and the ugly of co-working.

Through being a tenant, Dixon discovered that some spaces charge for extras like printing or using a meeting room. It made him determined to have an “all-inclusive” offering when he opened his office space.

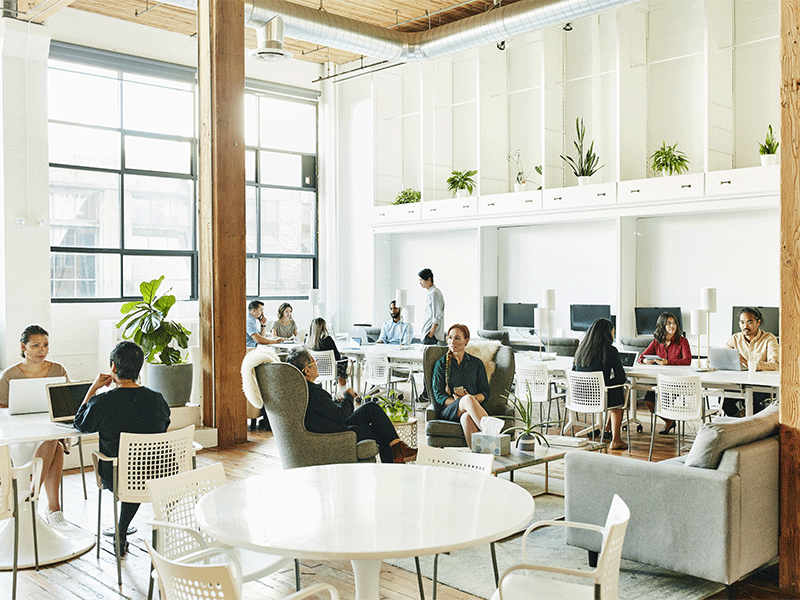

By being a tenant first you’ll work out the practicalities of the building before committing to it long-term. Picture: Ross Campbell

2. Survey the landscape

Next, Dixon recommends checking out what is being charged in the local area and what’s included for that price.

This helps to get a sense of what a fair market rate is, he says.

3. Crunch the numbers

Now it’s time to look at all the costs associated with opening the shared office space, beginning with a summary of all “base” costs.

“Your biggest expense is the mortgage or the rent you pay as the owner or leaseholder, and then you have other things on top, like the internet, public liability insurance, ongoing subscriptions, such as music services and printing consumables,” Dixon says.

Summarise this into a monthly break-even point, which might be $5000, for example. You then know that you need income above this point to break even.

Be sure to crunch the numbers on the space before you make any decisions about fit-out. Picture: Ross Campbell

Also, make a budget for set-up costs, such as furniture fit-out and installation fees for data cabling, lighting etc.

“You need this re-paid with the rental income over time, but I don’t treat this as a base operating cost. You can basically recover this sum over time, ie amortised,” Dixon says.

“For example, if you’re the main tenant and you’re sub-leasing a space on a three-year commercial lease, then you know you’ve got three years to recover those set-up expenses, as well as make a profit on top.”

Keep in mind you won’t always have 100% occupancy, so allow for a couple of empty desks or 10% of the room to be unoccupied when working out profit margins.

4. Think about the bottom line

How much you charge per desk or per person depends on how the shared office space is set up.

Are you wanting some room for your own business to grow in the future and do you just want to fill up the other desks and share the cost of rent with others? If so, you may not worry as much about profit and perhaps just want to share the burden of the lease and operating costs.

Think about how you want the space to work for you for the long term. Picture: Ross Campbell

“Or, if you are approaching this as a business, you need to understand your costs of having the space in order to set your rate,” says Dixon, who in his experience, finds small businesses or start-ups can afford about $150 per week, plus GST or $650 per month.

But remember, $150 per week does not equal $600 per month, due to there being a few five-week months throughout the year. Calculate $150 x 52 weeks and divide by 12 months.

“Remember also that people want a good deal in a great building and it’s better to charge a little less and have a full room, than charge high and have lower occupancy,” says Dixon.