Grocon administration documents reveal Daniel Grollo owed $1m

As the creditors’ meeting for Grocon on Wednesday approaches, the construction giant’s till appears near empty, with its report of assets revealing only $614,814 in the bank.

This is in addition to $12,262 in office furniture and equipment at its Melbourne office.

This comes in the face of debts of almost $20m listed in the creditors’ report owed by Grocon to creditors outside of a plethora of related-party loans.

The report does not capture debts claimed by Impact Investment Group, which is in dispute with Grocon over its Collingwood site, or those by APN on its Collins Street site.

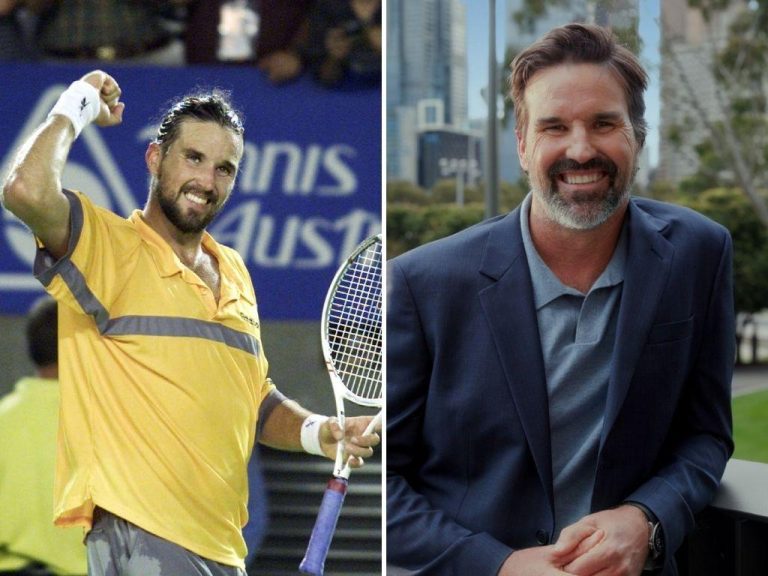

Grocon owner and CEO Daniel Grollo has also been revealed as being owed more than $1m in annual and long service leave entitlements.

KordaMentha administrators had declined to reveal the identity of the employee with the huge leave balance in the company’s first creditors’ meeting. But a spokeswoman for Mr Grollo confirmed he was owed the money due to his role as a director of the company.

“As a director of the company, Daniel does not receive the same priority as all other employees and these entitlements form part of the unsecured creditor pool,” a spokeswoman said.

“Much of the amounts owed to Daniel are historical; he would, of course, pay all other genuine creditors before he paid himself.”

Mr Grollo owes Grocon almost $11m in loans taken from the group.

Ploutus Pty Ltd and Grocon Funds Management, both of which are linked to Mr Grollo, also owe $5.5m between them.

The long-running court battle between Grocon and the NSW government over the sale of its Barangaroo site, which Grocon claims resulted in it losing $270m, is being touted as the saving grace for the ailing corporate empire.

The construction giant owes creditors more than $20m, including millions more in related-party loans to other Grocon corporate entities.

Grocon owes the taxpayer almost $14.17m in unpaid GST.

APN Property Group, which is making a claim for almost $14.9m plus costs and interest against Grocon, is calling for a liquidation of the group rather than a deal that could result in creditors walking away with a significant haircut on sums owed.

“We’re still concerned money has been taken out of the group. We still believe a liquidation may be a better route for recovery of all the creditors,” an APN spokesman said.

“A liquidation process will enable a detailed investigation to be undertaken in order to recover funds transferred out of the group to Mr Grollo, Ploutus Pty Ltd and the Grocon Funds Management/build to rent business which total $28m.”

ASX-listed APN Property is backed by Mr Grollo’s father Bruno and brother Adam.

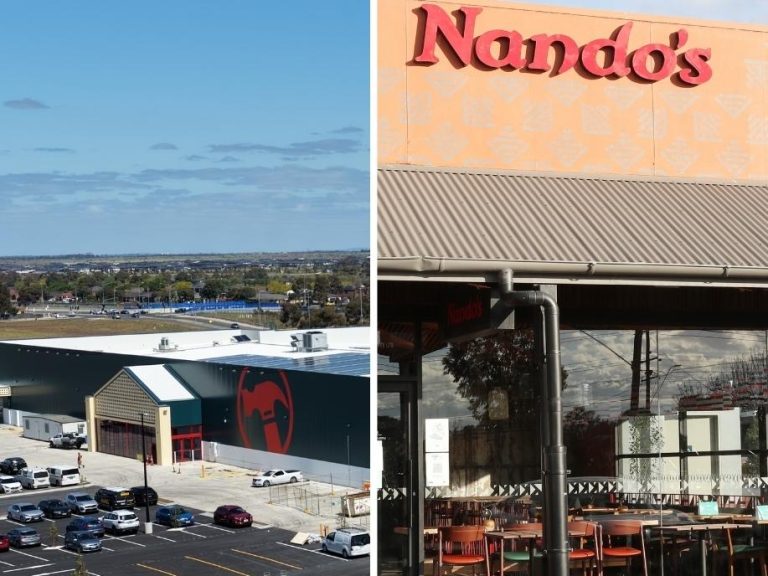

The creditors’ meeting on Wednesday comes only weeks after Mr Grollo tipped three more entities into administration on New Year’s Eve, including its troubled Northumberland Street development.

Grocon is believed to owe subcontractors on the Northumberland Street site as much as $8m.

Impact Investment Group, owners of the site, are claiming Grocon has left it $28m in the lurch through the collapse of works on the $110m project.

The Australian has revealed one of the corporate entities wound up by Grocon on New Year’s Eve was used by the construction giant to contract to the Victorian government for the $75m bushfires clean-up.

Grocon, which dominated the east coast development market for decades, building some of Melbourne’s most memorable landmarks, has been in parlous financial health in recent years.

This article originally appeared on www.theaustralian.com.au/property