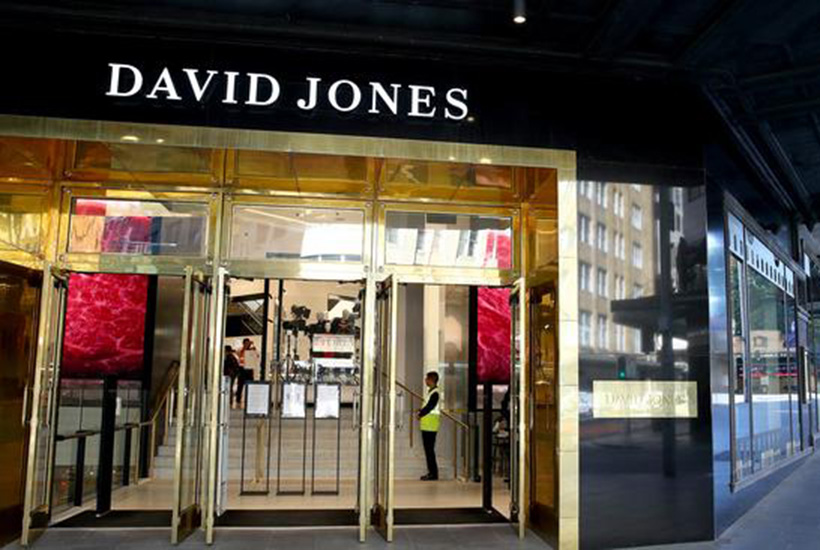

Australian department store David Jones is poised to launch the sales process for its $1 billion property portfolio, with promotional material being sent out to the market next week.

On offer are the flagship David Jones properties in the heart of Sydney and Melbourne, through investment bank UBS, with further details of the offering to be revealed in a flyer document received by interested buyers in the coming days.

Typically, at the top of the list of likely acquirers are high profile listed shopping centre landlords such as Scentre Group, Vicinity Centres, Dexus Property, Mirvac, AMP Capital or Stockland.

However, given the current challenges such landlords are facing, where tenants are demanding rent reductions due to COVID-19, the thinking is that wealthy investors will step up to the plate, given the properties are considered top quality.

In particular, wealthy individuals like Morry Schwartz could have an interest, drawn to the assets because of the option to transform the properties into exclusive hotels should the retail sector stage a further demise.

Retail property billionaire John Gandel may also have interest, as could the interests of retail billionaire Solomon Lew.

However, institutional investors and pension funds are also not to be discounted as prospective buyers, given that many remain flush with cash despite challenging conditions related to COVID-19.

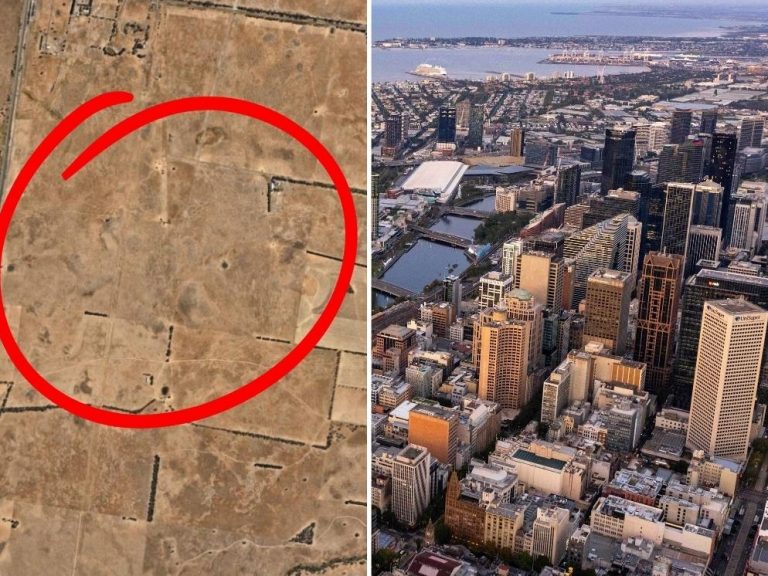

The sites will no doubt be highly sought after, but the ability for an alternative use will be at the forefront of the minds of many, as David Jones — like department stores globally — battle for survival due to the growing online shopping trend.

David Jones is selling its two most prized assets as it searches for ways to drive down debt while grappling with declining sales.

The department store has already offloaded properties to free up cash, selling its Market Street building in Sydney’s CBD to Westfield owner Scentre Group and Cbus Property for $360 million in 2016.

Both UBS and restructuring firm KordaMentha are now assisting the department store owned by Woolworths in South Africa on a range of fronts.

The stores that will be placed on the market are located in Elizabeth Street in Sydney and Bourke Street in Melbourne.

In May, Woolworth South Africa’s Australian operations, which include DJs and the Country Road Group, won a waiver from its lenders on its debt covenants and secured a $75 million loan from its parent company, as it remained in negotiations with landlords to secure lower rents.

Sales fell 35% during COVID-19 when shoppers were forced into home isolation, although DJs kept its stores open during the worst of the pandemic and online sales were strong.

This article originally appeared on www.theaustralian.com.au/property.