Commercial property update: Industrial and tourism assets shine in 2023

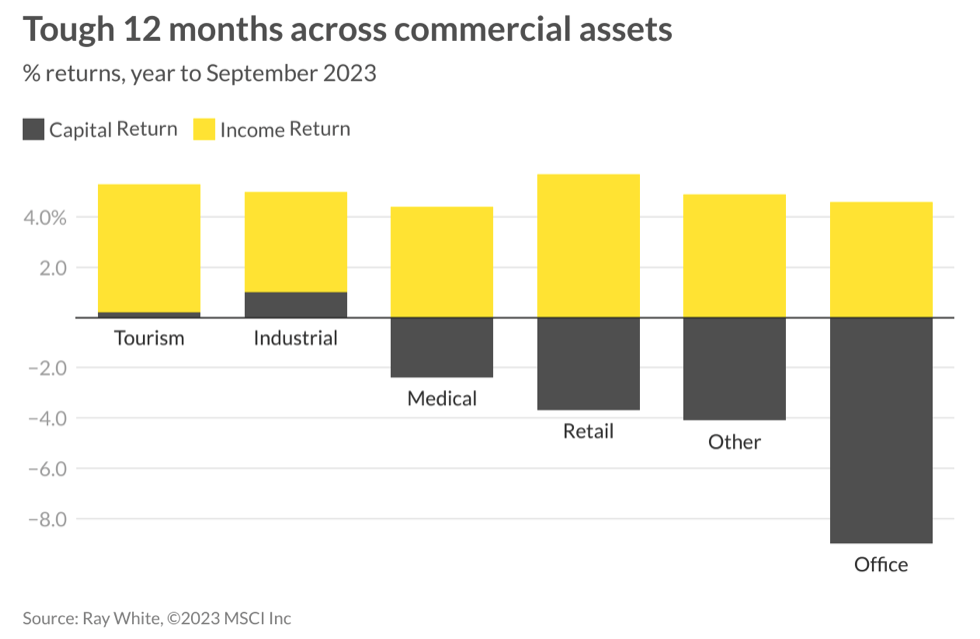

In a challenging year for commercial property, tourism and industrial assets have outperformed with strong demand underpinning positive capital returns in a year where every other asset class went backwards.

Despite higher interest rates driving up the cost of finance, the latest MSCI returns data showed positive growth in both income returns – driven by rental growth – and capital returns – growth in the value of the asset – over the year to September. Capital returns went backwards in all other asset classes as buyers demanded higher yields to counter higher funding costs.

Over the year, industrial assets yielded total returns of 5%, just behind tourism at 5.3%.

Asset values and yields have an inverse relationship – when interest rates rise, investors expect to receive a ‘premium’ for investing in riskier assets such as commercial property, driving up the required yield on investments and reducing the amount they’re willing to pay for that asset.

But with supply shortages driving strong rental growth in certain sectors, Ray White Commercial head of research Vanessa Rader said some asset classes have managed to weather the storm better than others.

“Encouragingly, income returns continue to maintain, albeit slightly behind last year results, highlighting stable occupancy across many asset classes within the portfolios included,”Ms Rader said.

“Capital returns, however, have seen the greatest change impacting the total return results for most asset classes this year.

“Looking at total returns alone, the tourism sector and our uptick in occupancy and daily room rates for accommodation, coupled with increased domestic and international visitor nights, has seen this asset class reign supreme for 2023.”

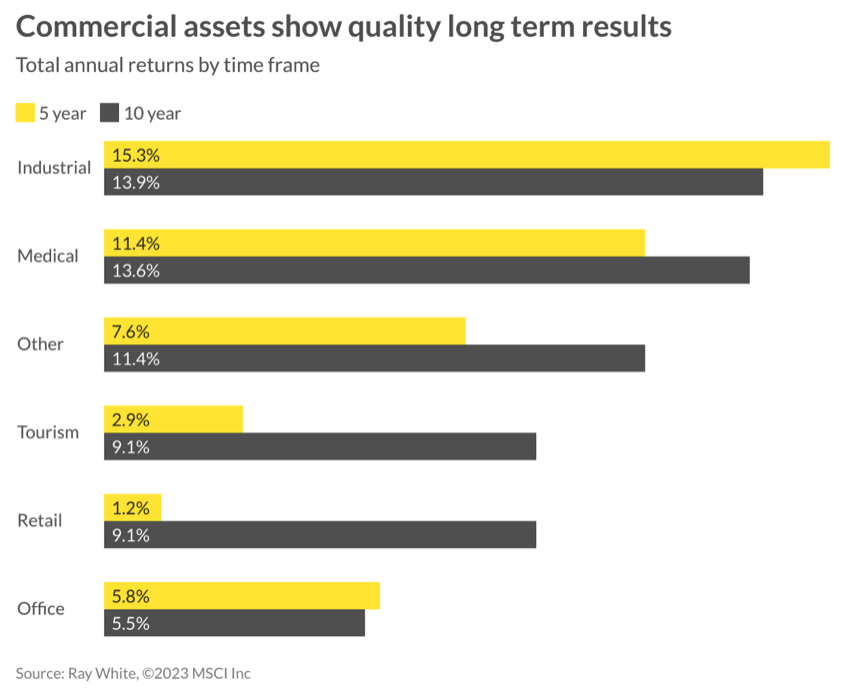

Longer term, Ms Rader said the industrial sector has cemented its number one position with five- and 10-year average returns outstripping all other asset types at 15.3% and 13.9% respectively.

“Over this longer term, the evolution of the industrial asset class has been outstanding. Previously considered a “dirty” asset, which held a discount to other asset classes, industrial assets have grown in sophistication and our demand to occupy, outpacing the supply of stock,” Ms Radar said.

It follows a challenging year for commercial property as a whole, as rising interest rates weighed on investment activity with both listings and transaction volumes down, as rising yields hit values.

Year-to-date, PropTrack economist Anne Flaherty said the total volume of commercial property sold in 2023 was at its lowest volume in more than a decade.

“In general, what I would say about the commercial market is that, in terms of the investment market, it has been in the doldrums this year,” she said.

“There’s a few factors behind this, I think that the biggest one is higher capital constraints, both in terms of higher interest rates and also stricter lending criteria.

“Overseas investment in commercial is also down, we’re seeing this across the board so both in Australia and globally, there has been a lot less investment in commercial property.”

Ms Rader said despite the woes of the last 12 months, commercial assets historically have been considered quality long term investment options.

“The rapid rate of escalation over the last few years – spurred on by inexpensive and available finance together with the desire for large institutions, funds, and smaller private buyers to diversify their portfolios – is all part of the volatility that these assets recorded.”

Lenders preference ‘safer’ alternatives to office and retail

Given the long-term outperformance of industrial, medical and certain specialised commercial assets, lenders are preferencing these ‘safer’ properties over office and retail, according to a new CBRE survey.

CBRE debt and structure finance managing director Andrew McCasker said in particular, there had been an uptick in appetite to lend for alternative assets, including data centres, specialised health care, life sciences, childcare and self-storage.

Lenders have a growing appetite to provide finance for specialised assets such as childcare centres over office and retail. Picture: Getty

“Sentiment towards the office sector has been compounded by a lack of sales evidence in the market to demonstrate a softening in yields,” Mr McCasker said.

“Until lenders have certainty as to the impact on values, they will continue to have a conservative view on this sector.

“However, we have seen a significant uptick in the appetite to lend on alternative assets following a marked increase in sales volumes and equity side investment appetite to build exposure to these emerging asset classes.”

Office and retail remains challenged

Nationally, the office market is still suffering from the impacts of the pandemic, affecting vacancies, effective rents, incentives and yields, Ms Rader said.

“The difficulty over the last few years, regarding limited demand and high supply in some markets, has hindered the returns for this historically attractive commercial asset class. Both five and 10-year returns sit at a similar level of 5.8% and 5.5% respectively,” she said.

“Unfortunately, future expectations surrounding occupancy and investment demand may see further short term declines in total returns making the historic long term prospects for offices more difficult.”

Office vacancy rates have continued to rise as more buildings are completed and tenants downsize to accommodate hybrid working. Picture: Getty

Ms Flaherty said vacancy rates continue to rise nationally.

“Particularly in Melbourne and Sydney, we’ve seen vacancy rates steadily rise since the onset of the pandemic,” she said.

“Those office markets have also been hit at the same time by a pretty big increase in the supply of new office stock, which is also contributing to higher vacancy and it’s also causing what we call a ‘flight to quality,’ where a lot of office tenants, looking at lower rents and more availability of high quality space and are shifting their offices to nicer places.”

She said the retail sector remains a ‘mixed bag’.

“What we’re seeing is investors are nervous about retailers that are exposed to discretionary retail segments,” she said.

“But on the other hand, we’re continuing to see strong demand for assets like, grocery stores, essential retail, that sort of that sort of thing.”

Ms Rader said retail – which suffered through the pandemic – recorded a five-year average growth of just 1.2%

“Medical has been a key area of investment interest this year, however, underlying pricing has seen capital growth in negative bringing total returns to 2%, the same rate as retail, having them tie for third place,” she said.

As markets continue to reset for the higher interest rate environment, Knight Frank’s latest Australian Horizon report predicts 2024 will be a better year to acquire assets.