Melbourne weighs on the property sector’s confidence

Housing is supporting confidence in the property sector. Picture: Pace Property.

Cautious optimism continues in the property sector as housing prices steadily climb but dark clouds linger over Melbourne’s market.

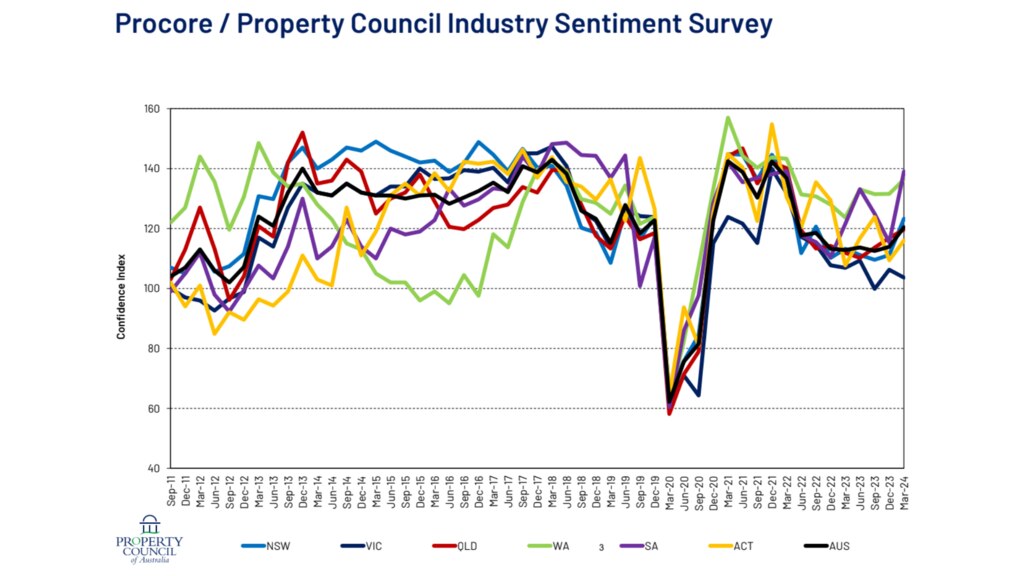

The latest Procore/Property Council of Australia Industry Sentiment Survey shows confidence in the property sector rose six basis points over the March quarter on a national level, led by strength stemming from South Australia and NSW.

But the Victorian industry was far less bullish about the future, particularly when it came to state and federal economic growth expectations and forward work schedules, and the state has behaved as an anchor against the national index.

Confidence in the property sector was broadly up through the March quarter of 2024. Picture: Property Council

Property Council of Australia’s group executive of national policy and advocacy Matthew Kandelaars said the expectation of falling interest rates was a sign of good news to come. “Certainly, there is cautious optimism in the sector,” he said.

“Of course, there are there are challenges that remain. If we focus on residential, stabilising and potentially lower interest rates is great for consumer confidence. It’s great for inquiries and conversions, but the challenges undoubtedly lie with delivery and supply.”

The Victorian government’s structural budget deficits and high tax environment make Melbourne an unattractive city for local and foreign capital investment, Mr Kandelaars said.

“Talking to our members … the clear message they are receiving from investors is that Victoria is an ongoing challenge,” he said.

“We’ve seen for some time now a steady and continued change to Victoria in taxation regimes. Property taxes make up a huge proportion of the Victorian state overall tax take, and that doesn’t go unnoticed by investors.

“The overall fiscal position of Victoria is one of our two largest centres is a big concern.”

Property Council of Australia group executive of national policy and advocacy Matthew Kandelaars.

Residential property prices were expected rise in all states and territories except the ACT, the country’s second most expensive housing market. The expectation is that interest rates are likely to be reduced in the coming 12 months, while many in the industry believe access to debt financing will become more readily available.

Industry players agreed that the delivery of more housing stock should be of the highest priority for state and federal government, followed by changes to planning regimes.

“Strong expectations for the next 12 months in respect of capital growth in residential property quite simply reflects … the critical shortage of housing across the nation,” Mr Kandelaars said.

“We have state and territory planning systems that are simply not fit for purpose. They are broken and it is absolutely imperative that we increase the supply of new homes across every jurisdiction, across every local government area and across every asset type.”

Confidence is generally up in the industrial and hotels sectors, with retirement also remaining buoyant because of its close links to residential property. Retail property held largely steady while sentiment towards offices fell, and the future of construction was also viewed as positive for all sectors except hotels.