Fund manager splashes $15.3m for Port of Airlie terminal

Brisbane-based fund manager Sentinel Property Group has made a dive into the tourism infrastructure market, acquiring the Port of Airlie Maritime Terminal for $15.3 million.

The maritime terminal, which is a gateway to The Whitsundays and the Great Barrier Reef, was acquired by the newly formed Sentinel Infrastructure (Airlie Beach) Trust on a 20-year leaseback, with a further 10-year option to Cruise Whitsundays.

It is Sentinel Property Group’s first acquisition in the tourism sector, although the group holds almost $1 billion worth of property assets nationally, comprising more than 30 retail, industrial, office and land assets.

Sentinel managing director Warren Ebert says: “The Port of Airlie Maritime Terminal is an irreplaceable slice of prime tourism infrastructure with a profitable tenant, positioned at the gateway to one of our most iconic tourism destinations.”

It is a great time to be investing in the tourism sector, which is rebounding strongly and has excellent growth prospects ahead

“The fact that this investment opportunity was 150% subscribed in just 24 hours shows that our investors support our ability to identify new emerging asset classes.”

Sentinel Infrastructure (Airlie Beach) Trust has a forecast minimum distribution of 10.4%pa for its first year (paid monthly and post interest rate/expenses contingency).

Recently, Sentinel Property Group has been active in the retail market, utilising its Sentinel Retail Trust to acquire three neighbourhood centres in New South Wales in May for a combined $21 million.

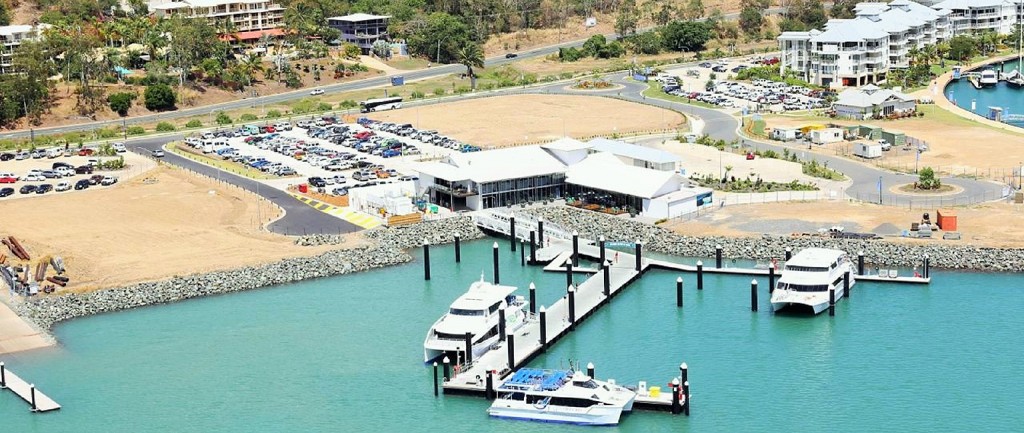

The Port of Airlie Maritime Terminal includes more than 300m of floating pontoon. Picture: Port of Airlie

In Queensland, the group acquired two neighbourhood centres – Emerald Village and Emerald Market – in November last year for $18.3 million and $14.7 million respectively.

The group is also the largest private owner of commercial property in Mackay, with six retail, industrial, office and land assets valued at more than $170 million.

Ebert says the shift to tourism infrastructure was in-line with Sentinel’s ‘first mover’ strategy aimed at capitalising on emerging markets.

“It is a great time to be investing in the tourism sector, which is rebounding strongly and has excellent growth prospects ahead,” he says.

The fact that this investment opportunity was 150% subscribed in just 24 hours shows that our investors support our ability to identify new emerging asset classes

“There is a new wave of major development projects underway in the region that will further enhance and grow its tourist appeal, including the $59 million upgrade of the Whitsunday Coast Airport.”

Completed in September 2014, the Port of Airlie Maritime Terminal comprises a passenger terminal building and administrative offices, cafe and gift shop, 310m of floating pontoon, 10 large vessel marina berths and a refuelling facility.

It features a freehold land area of 1,893sqm for the passenger terminal and a marina sub-lease area of 8,005sqm for the pontoon and marina berths.

Cruise Whitsundays is a key operator in the region, with 90% market share of all ferry and day cruise services in the Whitsundays, including exclusive ferry contracts with island resorts.

In the 2014-15 financial year, the company provided island resort connections to over 400,000 passengers and conducted day trips for an estimated 170,000 tourists.