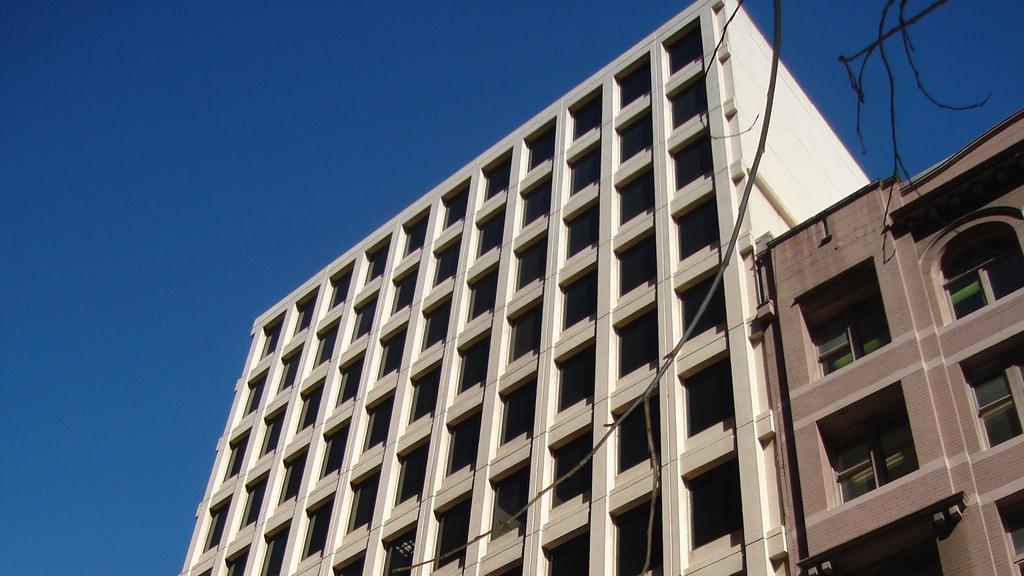

Forza shows the way with $138m swoop on city tower

Funds manager Forza Capital swoops on an A-grade block in the Sydney CBD, which was offloaded by a fund run by Investa for just over $138m.

The big reset of the city office market is picking up pace with funds manager Forza Capital swooping on an A-grade block in the Sydney CBD, which was offloaded by a fund run by Investa for just over $138m.

The funds house has launched an unlisted trust to back its purchase of the building at 117 Clarence St, with the deal reflecting an initial yield of just over 8 per cent.

It is the latest in a run of transactions indicating the market for high quality buildings is both active again, and reflecting the new interest rate environment and tougher leasing markets.

The building was sold by Investa Property Group’s flagship wholesale fund, which had picked up the block for $153m in 2018 from Singaporean groups Roxy-Pacific and Tong Eng Group when it had ambitions of a large site for a major tower.

It did not pursue these plans as the City of Sydney Council took an unsupportive stance, and it instead refurbished the tower. It is now focused on its premium office holdings, which many landlords believe are best insulated from the fall-off in value across the sector.

The parties and agents Cushman & Wakefield and Knight Frank did not comment.

Melbourne-based Forza has been active across different sectors as the market turns. In February, it teamed with Jayland to buy the Epping Hub, a large format retail centre in Melbourne, from the listed HomeCo Daily Needs REIT for $70.25m.

But it also has a long record in offices. In 2021, Forza picked up 399 Lonsdale St in the Melbourne CBD for $86.8m from Hong Kong investors and that year it also used a $30m loan from the Clean Energy Finance Corporation to buy and refurbish 200 Creek St in Brisbane’s CBD.

Forza is billing its latest move to clients as capitalising on counter-cyclical conditions to opportunistically acquire a high quality, fully-leased Sydney CBD office. It cited the dearth of buyers and market uncertainty for throwing up the opportunity to secure the refurbished 12-level offices for $138.14m.

The price equates to a yield of 8.02 per cent on passing net income and a rate of $11,042 a sq m.

It is in keeping with a series of deals being struck, with Dexus selling off towers in Market St and Margaret St in the Sydney CBD. Mirvac is also advancing sales in Margaret St and in Melbourne’s Collins St with Charter Hall expected to follow suit.

On Forza’s reckoning, the last time Sydney CBD assets traded at similar yields was after the global financial crisis, and the run of sales will give valuers evidence of a market reset.

The block spans 12,510sq m and 26 car parks and sits on a 1,283sq m parcel. It also has a 5 Star NABERS Energy Rating. It has a weighted average lease expiry of 3.63 years and this year four new leases were struck with a five-year renewal of the NSW government anchor tenancy.

Investa outlaid almost $5m on upgrades and Forza believes it is one of the most competitive in the city, and has forecast a 6 per cent average annual distribution yield on its trust.