Build-to-rent hits cost and tax hurdles as housing crisis bites

Blackstone owns build-to-rent buildings in Brisbane and Melbourne, but shelved plans to sell them last year.

The world’s biggest commercial property owner, Blackstone, would “love” to build more rental housing in Australia but the costs are too great, says real estate boss Kathleen McCarthy.

Blackstone, which owns more than $900bn worth of real estate globally, owns two build-to-rent (BTR) apartment buildings, in Brisbane and Melbourne, under its Realm brand.

The group shelved plans to sell the buildings last year, partly as big investors pulled back from the area in face of regulatory uncertainty, and is committed to seeing the sector work locally.

Speaking at the Asia Pacific Financial and Innovation Symposium in Melbourne, Ms McCarthy said Australia’s BTR sector was attractive because it was still in its early stages.

“Build-to-rent is very interesting here in part because it’s so nascent,” said Ms McCarthy, who is global co-head of Blackstone real estate.

“As far as appetite, we would love to do more. There are some factors that impact international investors, of which we are one of them, that frankly add more cost to being an investor in the sector.”

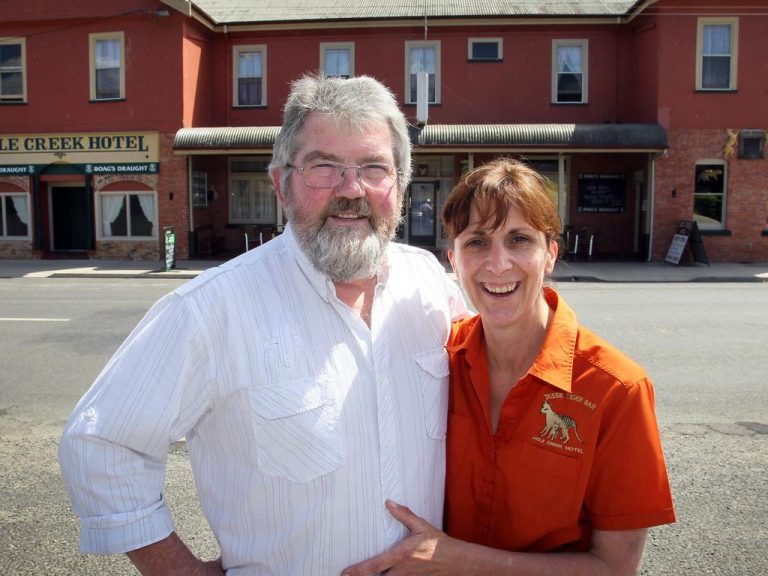

Global Co-Head of Blackstone Real Estate, Kathleen McCarthy. Picture: Jane Dempster

Ms McCarthy said countries facing housing challenges such as Australia should be trying to make it easier for international capital to flow freely in order to help address the problem.

“One of the things we’ve observed everywhere in the world is that costs, in various forms, have been added to construction costs effectively, and sometimes that is in the form of taxes, fees and other things,” she said.

“Government has a role in taking a look at that, and saying ‘what are we doing to make it (easier) to build housing and attract capital into the sector,” Ms McCarthy added.

“On the macro, it’s super attractive but there are factors that international investors have to think about here in Australia.”

The comments join a chorus of voices, including property groups and other international investors, calling on policymakers to lower the barriers to entry into Australia’s BTR sector.

It comes as the federal government mulls tax changes designed to attract more international investors into Australia to build more rental housing. The government is reviewing draft laws to allow eligible BTR managed investment trusts (MITs) to claim a 15 per cent withholding tax rate.

To qualify for the tax incentive, 10 per cent of the dwellings would have to be offered as affordable tenancies at a minimum of a 25 per cent discount to the rent charged in similar dwellings within the project.

Implementing a 15 per cent MIT withholding rate, without an affordable housing mandate, could lead to the creation of 150,000apartments by 2033, according to 2023 EY modelling commissioned by the Property Council of Australia.

Property Council group executive policy and advocacy, Matthew Kandelaars, said the details of the draft legislation would make or break the delivery of these new homes and achieving the national housing target.

An artist’s impression of the triple tower Greystar development being built at Fisherman’s Bend.

“The enormous potential of a 150,000-apartment pipeline hangs in the balance and there’s only one chance to get this legislation right,” Mr Kandelaars said.

“Affordable housing is a crucial part of a broader housing mix, which is why we proposed an additional model that would protect the pipeline of 150,000 BTR apartments and deliver a further 10,000 affordable rental apartments at no extra cost to the taxpayer.”

Under the PCA’s alternative model, lowering the MIT withholding tax rate further to 10 per cent for BTR projects with an affordable housing component could accelerate the delivery of 10,000 affordable homes over 10 years, on top of those 150,000 rental homes.

The Albanese government has set a steep national target of building 1.2 million new homes over the next five years to help alleviate the country’s housing crisis.

And local players are also moving on their projects, but they say that getting policy settings right will be crucial.

Investment house AsheMorgan’s District Living project in Melbourne’s Docklands is set to become one the country’s largest build-to-rent developments after being endorsed by the Future Melbourne Committee earlier this month.

The $700m-plus project will have more than 900 BTR apartments across two buildings on Little Docklands Drive.

An artist’s impression of the $700 million “District Living” development proposed for Docklands.

AsheMorgan development director Mat Stoddart said improving the GST treatment of the sector was another opportunity to help boost the BTR supply. “Aligning it to other institutional income-producing assets, like commercial, would help the financial viability of BTR projects,” Mr Stoddart said.

He said overseas investment was a significant source of funding for the sector.

“We need to continue to build on the positive work from the government to date as it relates to any incentives and concessions for foreign investors in BTR, as this could help realise more projects,” he said.

Others are also moving ahead. Novus, in partnership with British funds manager M&G Real Estate, has just topped out its Novus on Sturt project in Melbourne’s Southbank. The 163-apartment development will be finished later this year.

Novus chief executive Adam Hirst said that equal MIT treatment for BTR with other asset classes would drive a significant supply of new housing. He said this should apply to both income and capital and in perpetuity for MIT structures, rather than a 15-year limit, which could create a lack of certainty.

“It’s only becoming harder to get these projects off the ground and this is a zero-cost way for the government to drive significant investment into the sector. They don’t have to put any money in; this is a privately funded solution,” Mr Hirst said.